Manhattan Office Market Update- 1Q2024

SPACES COMMERCIAL REAL ESTATE

212-300-3265

jack@spacescre.com

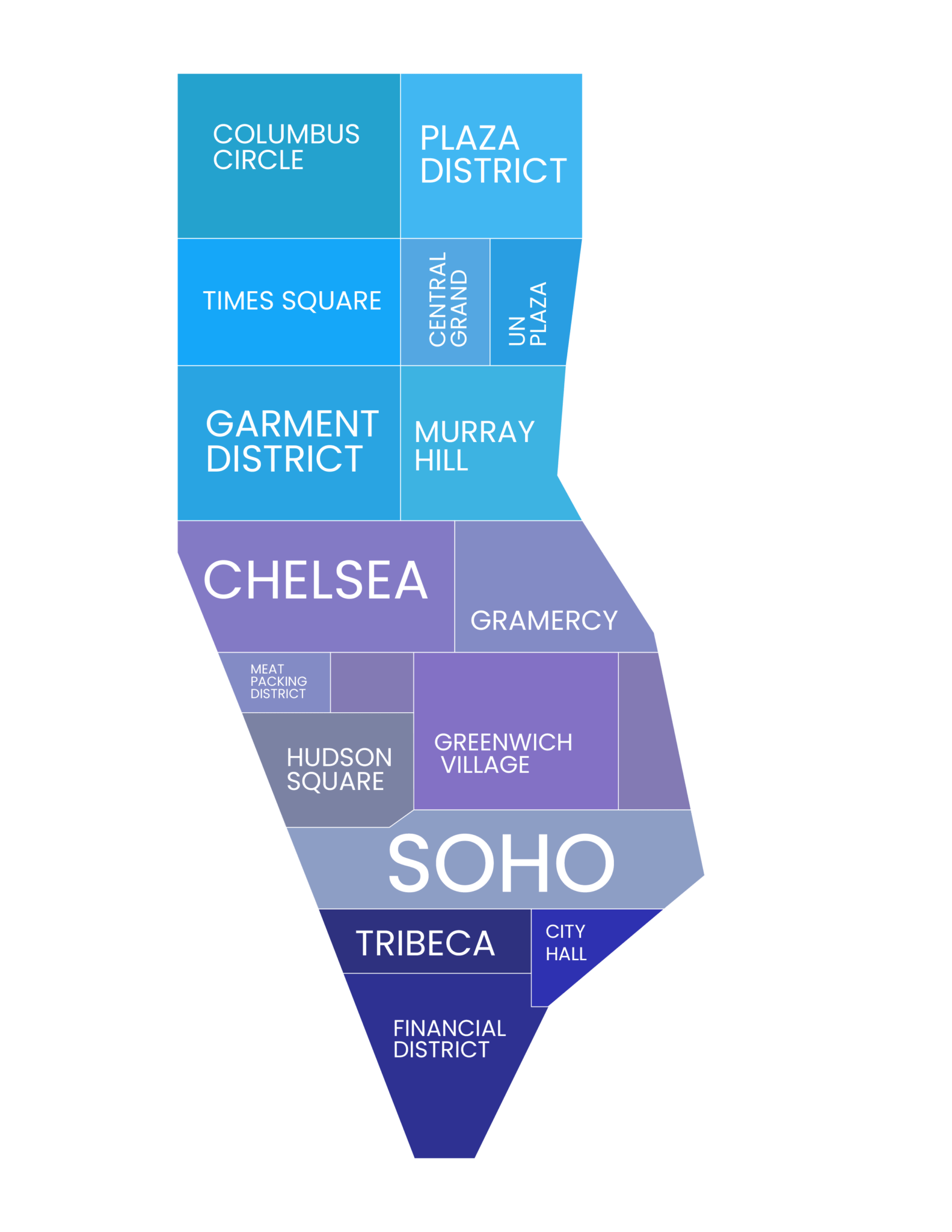

The Manhattan office space market has never been as dynamic and fractured as it is today. While some submarkets are experiencing an increased vacancy rate and decreased rental rate, others are experiencing a decreased vacancy rate and increased rental rates.

The Manhattan office space market has never been as dynamic and fractured as it is today. While some submarkets are experiencing an increased vacancy rate and decreased rental rate, others are experiencing a decreased vacancy rate and increased rental rates.

In Midtown, the flight to quality is further widening the divide in asking rents and vacancy rates between Class A and Class B & C properties with the former steadily leasing space and the latter experiencing limited demand. Other notable trends are the shift to smaller built spaces and shorter term leases.

Midtown South, which is predominantly occupied by tech and tech related businesses, has been slower to recover as the tech industry has not yet transitioned back to the office to the degree that service businesses such as law firms and financial services firms have. Despite this slow demand high quality, built, and furnished spaces are leasing.

Regardless of the direction of the market and in which market you look, you can be absolutely sure that you’ll find tremendous value both for fully built and furnished sublease spaces and customizable direct space options.

Hover over the submarkets in the map below to explore Average Rental Rates, Vacancy Rates, and the movement direction for 1Q2024.

Source: Costar, Inc.

NOTABLE

LEASE COMPS

| Tenant: | Coinbase |

| Building: | One Madison |

| Premises: | Partial 54th Floor- 6,454 RSF |

| Rent: | Years 1-5: $168.00/ RSF Years 6-10: $178.00/ RSF |

| Term: | 10 Years |

| Free Rent: | 6 Months |

| Notes: | Landlord is building the space with a contribution capped at $160.00/ RSF. |

| Tenant: | White Mountain Capital |

| Building: | 650 Fifth Avenue |

| Premises: | 14th Floor- 4,271 RSF |

| Rent: | Years 1-5: $78.00/ RSF |

| Term: | 5 Years |

| Free Rent: | 6 Months |

| Notes: | Newly built space |