Few industries have faced as much uncertainty over the past few years as the commercial real estate industry- particularly the office space sector. Over the past three years the asset class went from the darling to the dog. Hit particularly hard during the pandemic, building owners are facing the perfect storm- high operating costs, high interest rates, low demand, and low liquidity. It seems that no one is immune with institutional owners like RXR and Blackstone and mom and pop landlords alike giving the keys to non performing assets back to their lenders.

One thing is clear in this market- landlords can’t afford to lose tenants. Tenants who are in tune with this reality could take advantage of the opportunity to secure advantageous lease terms that will increase profitability, flexibility, and reinforce their competitive edge.

Short Term Opportunities

(click to expand)

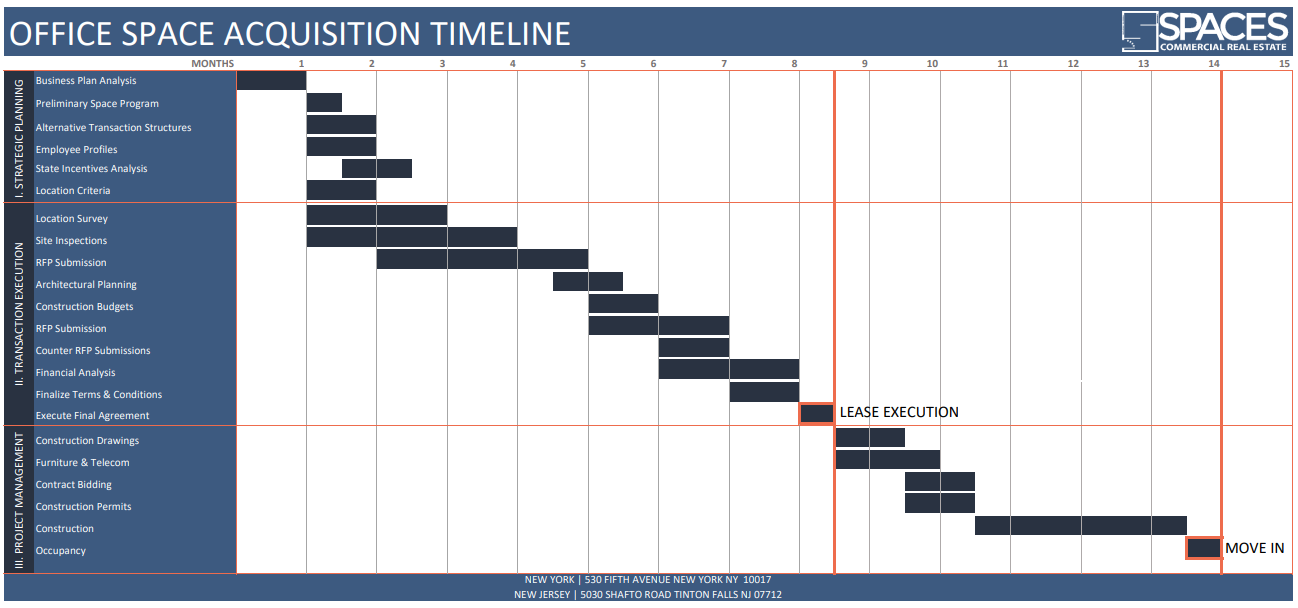

The typical time frame for a tenant to start exploring alternatives is 12-24 months from lease expiration. For businesses with lease expirations in this time frame there are opportunities abound. Landlords with current or imminent vacancy have a heightened sense of uncertainty and will be deperate to lure you to their building or keep you as a tenant. Additionally, there are opportunities for savings by exploring the plethora of furnished and wired subleases from corporations that are looking to shed space. This is also an excellent time to reassess your occupancy needs and reshape your current or future space to suit your business. Whether you choose to renew your lease or relocate, building leverage can help you negotiate advantageous lease terms, including free rent, tenant improvements, and moving incentives, as well as favorable lease clauses that offer flexibility for your business, such as renewal, termination, and expansion options..

Mid – Long Range Opportunities

For businesses with 24-48 months remaining on their lease, there are still opportunities. If your business has changed and your space no longer reflects how your business uses office space, maybe you need less space, more or less offices, or employee demographics steer you to a different location, then you can look to sublease your space and explore alternatives.

Another option would be to restructure your lease by exchanging lease term- something landlords covet- for what’s important to your business whether it’s a lower rent, additional tenant improvement allowances, free rent, or all the above. While the concept is straightforward, determining how much value your tenancy is worth to ownership and what you can extract from ownership in exchange for term involves complicated rent assumptions and projections and is complicated to do it right.

Out of the Box Options

Economists are projecting that the value of office assets could drop 30-50 percent off their pre pandemic high. This could be an opportunity for businesses with a significant footprint to purchase a building. Further with the number of loans going into special servicing and receivership expected to balloon, businesses could scoop up the debt or purchase the assets out of forclosure with a tenant in hand (themselves).

Even more interesting are landlord tenant partnerships like the one recently struck by Citidel, Vornado, and Rudin where there’s a mutually beneficial relationship with the landlord having a tenant certain while the tenant has some control over their building without having to operate it and see the upside in asset value from thier own tenancy.

If you’re interested in exploring how you can immediately reduce your occupancy costs then CLICK HERE to connect with a broker or fill out the form below